The “Pilot Phase” is almost over for the Illinois Secure Choice program, enacted under the Secure Choice Act of 2015 (State Site). That means that by 11/01/2018, every Illinois company with more than 500 employees, that has been in business for two years or more, will be REQUIRED to provide a retirement savings program or be forced to use the Illinois Secure Choice program for their employees.

But, wait, it doesn’t stop there – companies with 26 to 499 employees will also be required to provide a retirement savings option, or use the state program, by the following dates:

- An employer employing 100 to 499 employees: 7/1/2019

- An employer employing 25 to 99 employees: 11/1/2019

- An employer employing under 25 employees: Optional

Luckily, clients of MidwestHR have an option over using a state mandated (and manipulated) program. MidwestHR offers a 401k retirement savings program that meets all parameters as a “qualified plan” under the Illinois mandate.

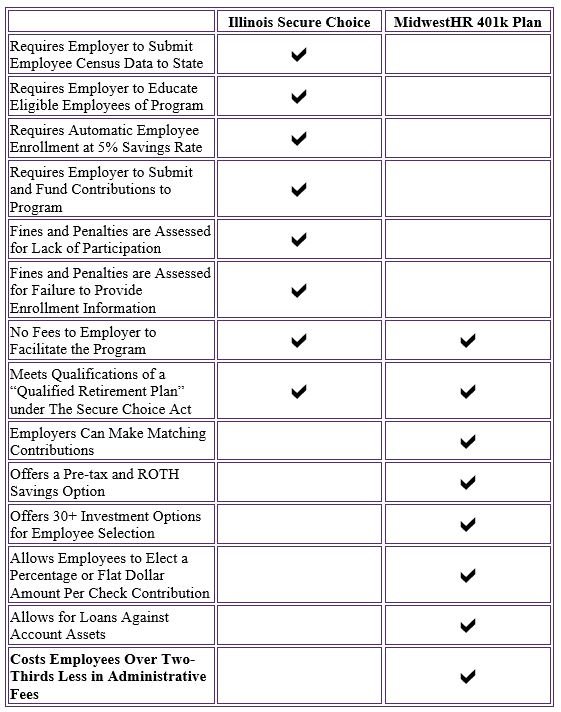

Here is how the mandated program stacks up against MidwestHR’s 401k Plan:

The MidwestHR 401k plan also offers choices in age requirements of eligible employees, waiting periods, minimum hour requirements and vesting schedules. The MidwestHR 401k takes care of eligibility, enrollment, payroll changes, submission of contributions and participant communications.

Get ahead of the deadlines and reach out to the MidwestHR 630-468-9286 to utilize our services and have a retirement plan ready to satisfy this mandate.

Compliance has never been so easy!